Table of Content

The DPA can be used toward the down payment, closing costs or a combination of the two. The DPA is only available in conjunction with a HOME Plus mortgage. Why continue to pay someone else's mortgage, while you can pay your own mortgage.

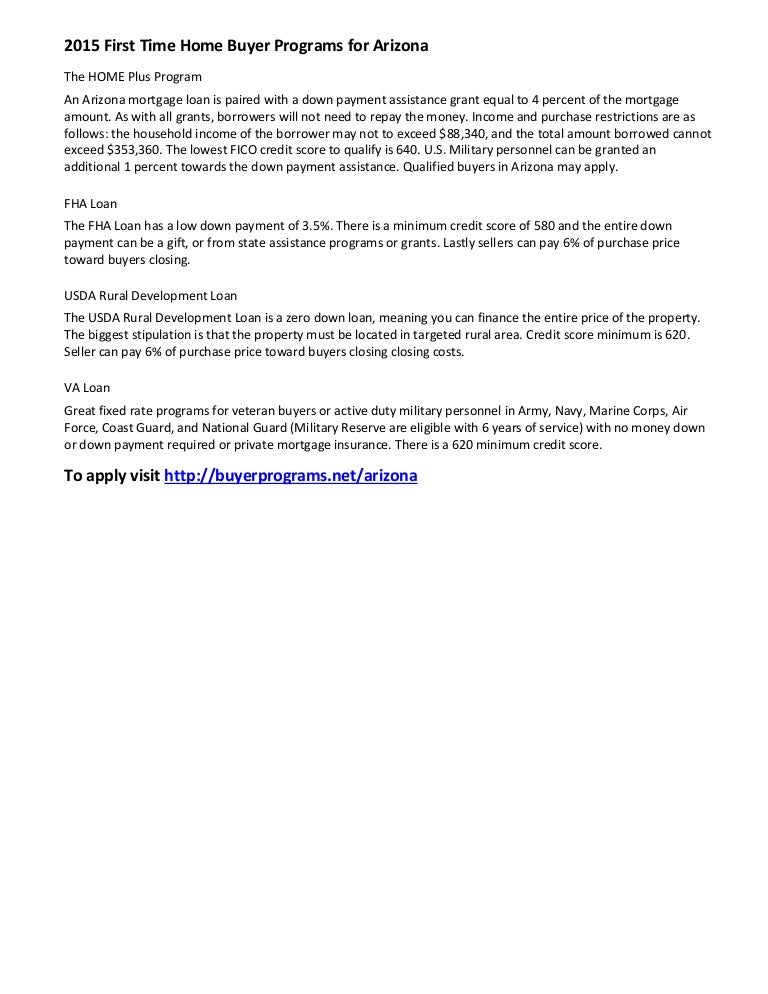

You must have a credit score of at least 580 on the FICO® scale to uncover that 3.5% rate, though. If your score falls anywhere between 500 and 580, you’ll need to make a down payment closer to 10%. At just half the size of a usual mortgage down payment, that’s still a great deal. In fact, even with the credit score requirement, an FHA loan is one of the easiest federal programs to qualify for. The Arizona Housing Finance Authority, also known as AzHFA, is a state housing finance agency for Arizona.

Who is considered a first-time homebuyer in Arizona?

FHA Loans– FHA loans are a good option for borrowers who may not be able to qualify for a conventional loan. The qualification requirements for FHA loans are much more lenient than conventional loans. This includes options for home buyers with credit scores as low as 500 (in order to qualify for a 3.5% down payment, you must have a credit score of at least 580). Are you a first time home buyer looking to purchase a home in Phoenix, Arizona? On this page you can learn about the different types of mortgage programs that are available to first time home buyers.

Many of these programs do not require you to be an actual first time home buyer. They are referred to as first time home buyer programs because first time buyers utilize them. For government-backed loans, such as FHA, VA, and USDA loans, you can buy a home with tax debt as long as you have made a payment plan with the IRS, and are not behind on the payments. Any federal debt must be in good standing in order to get a government-based mortgage. If your tax debts have moved into the status of a tax lien, this will prevent you from getting a home loan until it is resolved. The minimum down payment requirement will depend on the type of mortgage program.

Do first-time homebuyers with bad credit qualify for homeownership assistance?

Your lender can help you check your eligibility for this extra support. The First-Time Home Buyer Tax Credit Act is working its way through Congress. The first-time buyer program would refund up to $15,000 in tax liability to first-time home buyers retroactively to December 31, 2020. Mortgage rate discounts for first-time buyers vary based on credit score, down payment size, and property type. A first-time home buyer grant is a cash award paid to new US homeowners. Governments award grants on the local, state, and federal levels.

AzHFA partners with private sector mortgage lenders who qualify borrowers and offer the program to eligible first-time homebuyers in the state. To learn more about AzHFA and for a full list of participating lenders visitArizona Housing Finance Authority’s website. A home creates an asset that provides the ability to create wealth, borrow and achieve self-reliance.

First Time Home Buyer Programs in Arizona

Yes, the appropriate conclusion MAY be to continue renting, but you should objectively review your rent-vs-buy analysis at least yearly. If you are renting in metro-Phoenix, I can state this as fact without even knowing the details of your rental, your rent is higher than all costs of owning, and very possibly way higher. Tax credits are reductions to a person’s federal tax liability to promote specific buyer behaviors, including buying a first home. Five years later, if the buyer still lives in the home and has made on-time payments as agreed, the lender will write off the smaller $15,000 mortgage. The Good Neighbor Next Door Program is a US Department of Housing and Urban Development program that sells homes to first-time buyers at half-price. Good Neighbor Next Door is available to teachers, firefighters, law enforcement officials, and emergency medical technicians who want to live in the same community where they work.

The first step towards getting closing cost assistance is getting pre-approved. If you’ve ever heard of cities paying people to move, you’ve seen forgivable mortgages in action. Governments love them because forgivable mortgages boost homeownership, neighborhood, and community investment — the three pillars of a robust municipal economy. Buyers with high credit scores get significant adjustments, too. Pima’s DPA fact sheet says that there’s a “Period of Affordability” during which you’ll have to repay the loan if you sell the home, transfer, or refinance your main mortgage.

Downpayment Assistance

Buy a house in Arizona using the best down payment assistance programs available. Deferred mortgages are available for up to $25,0000 via municipal governments and local foundations. They’re frequently limited to first-time buyers whose income falls below area averages and whose credit history shows a record of on-time payments. To find your assigned FHFA first-time buyer mortgage rate discount, get a complete pre-approval, including a credit score and income check. Buyers with low credit scores and small down payments get the largest interest rate adjustments on their Fannie- or Freddie-backed loans.

So you may have to look elsewhere if your credit score’s an issue. The Home Plus program offers a 30-year fixed-rate mortgage that can be paired with down payment assistance of up to 5 percent. The Arizona Industrial Development Authority administers Home Plus AZ, which is a mortgage program open to Arizona first-time home buyers everywhere in the state. The Arizona Department of Housing and Arizona Home Foreclosure Prevention Funding Corporation have worked with Pathway to Purchase as a way to provide upfront assistance for down payments and closing costs. Please feel Free to ask about any and all Arizona Down Payment Assistance programs that fit best for you.

This makes the prospect of using these options worth the time and effort. The benefit of a conventional loan comes in the form of a lower interest rate and more affordable mortgage insurance. In the long run, this means smaller monthly payments for your new home.

Like the Freddie Mac program, HomeReady loans allow flexibility for down payment financing, such as gifts and grants. Several federal government programs are designed for people who have low credit scores or limited cash for a down payment. Although most of these programs are available to repeat homeowners, like state programs, they can be especially helpful to people who are buying a first home or who haven’t owned a home in several years. Buyers can also use theHomePath Ready Buyer programand receive a 3 percent cash contribution toward the mortgage closing costs.

No comments:

Post a Comment